Malaysia, Thailand announce intention to apply to join the group after the UAE, Egypt, Iran and Ethiopia early this year

The number of members of the group will double in 2024, bringing together a number of the largest energy producers and some of the largest consumers in developing countries, which may enhance the economic weight of the group in a world dominated by United States.

1) Who are the new members of BRICS?

The BRICS group expanded at the beginning of January to include Iran and. The UAE, Ethiopia, and Egypt, and it was announced that Saudi Arabia would join as a new member, but the Kingdom later said that it was still studying the invitation.

BRICS is also likely to expand further, after declaration of Malaysia and Thailand expressed her intention to join the group.

2) What is the motivation for BRICS expansion?

I drove China, which has now become the world’s preeminent industrial power, is primarily pursuing expansion efforts, as it seeks to enhance its global influence by attracting countries usually allied with the United States. South Africa and Russia supported this expansion.

For its part, India hesitated at first, as it feared that BRICS would turn into a mouthpiece for China with the increase in the number of members, while the exclusion of the West was a source of concern for Brazil, but the governments of the two countries eventually agreed to the expansion.

BRICS offers new members easy access to funding from wealthier members and a political platform beyond the influence of Washington. Foreign Minister said Thailand, Maris Sangyampongsa, said that the bloc “represents a cooperation framework between countries of the Global South that Thailand has long wanted to join.”

Brazil, Russia, India, China and South Africa (emerging market economies known as BRICS) accounted for 19% of global GDP on a purchasing power parity basis in 2001.

Currently, the share that includes countries scheduled to join the bloc is 36%, and the percentage is expected to rise to 45% by 2040, more than double the share of the G7 economies.

The rapid rise of the BRICS group is changing the global economy. Member states generally have less democracy and freedom than advanced economies, and growing economic weight could result in a massive shift in influence. However, the bloc lacks homogeneity, which will stand in the way of the ambitious goals of some of the group’s countries, such as competing US dollar On its dominant role globally.

From growth calculations to a political project

The BRICS name began when Jim O’Neill, then chief economist at Goldman Sachs, set two criteria for membership: Countries had to have a large economy already and be prepared to grow rapidly. Brazil, Russia, India and China came to the fore. As an added bonus, the acronym for the bloc provided its appeal.

The idea proved to be hugely successful. The original BRICS group achieved remarkable growth during the first decade of this century. In an unusual example from a geopolitical standpoint, they united to form a bloc, which South Africa joined in 2010, based on a recommendation contained in a research note from a Wall Street bank.

During August of this year, the BRICS group called 6 other countries to join the bloc are Argentina, Egypt, Ethiopia, Iran, Saudi Arabia and the United Arab Emirates.

There is no new abbreviation for the economic group’s name, but the name will likely be changed to BRICS+. Those joining the group also expand O’Neill’s original membership criteria, but remain there other eligible candidatesMore out of the cluster.

3) What is the impact of the increase in the number of BRICS members on the world?

Including major fossil fuel producers could give the group greater scope to challenge the dollar’s dominance in trade oil and gas, by switching to using other currencies, a concept called “abandoning the dollar.”

However, analysts at Bloomberg Economics see the expansion as “more focused on politics, and less on the economy.”

The coalition, after increasing the number of its members, may constitute a more powerful counterweight to what is being called group of seven, which includes the United States, Canada, France, Germany, Italy, Japan, and the United Kingdom, as Beijing seeks to build an alternative world order by attracting the countries of the southern hemisphere to its economic circle, in challenge to American hegemony.

The Russian President is also keen Vladimir Putin. After the United States and its allies isolated him from the world as a result of the war in Ukraine, he will witness the decline of Washington’s global influence.

There are other alliances that promote the trend toward a more multipolar world, far from American hegemony in the post-Cold War era, and among these alliances is “OPEC”. The Shanghai Cooperation Organization, the Southern Common Market (Mercosur), and the African Union.

4) What does BRICS do?

The group’s biggest achievements so far have been financial, with countries agreeing to amass $100 billion in foreign currency reserves, which member states can lend to each other in emergencies.

This liquidity pathway became operational in 2016, and member states established the New Development Bank, a financial institution modeled on The World Bank. Since the start of its activity in 2015, the new bank has approved loans amounting to about $33 billion, directed primarily to water, transportation, and other infrastructure projects.

It is noteworthy that South Africa borrowed $1 billion from the bank in 2020 to address the Corona pandemic, compared to the World Bank’s allocation of $72.8 billion to member states in the fiscal year 2023.

5) How have trade relations changed?

The volume of trade between the first five member countries of the group increased by 56% to reach $422 billion between 2017 and 2022.

Economically, Brazil’s natural resources and agricultural crops are Russia. It made them natural partners for Chinese demand. For its part, trade relations between India and China are weak, due to their geopolitical rivalry and the simmering border dispute between them, among other reasons.

6) How did BRICS start?

Economic analyst Jim O’Neill coined the term “BRIC” in 2001, while he was then working for Goldman Sachs, to draw attention to the significant economic growth rates in Brazil, Russia, India and China.

The term was intended to create an optimistic scenario for investors, amid market pessimism after the September 11 attacks in the United States in the same year. The four countries accepted and developed the concept, as their rapid growth at the time indicated that they had common interests and challenges, and that uniting their voices might enhance their influence.

Russia organized the first BRIC foreign ministers’ meeting on the sidelines of the UN General Assembly session in 2006. The group held its first summit of heads of member states in 2009. An invitation was extended to join the South Africa. In 2010, the group included a new continent and added the letter “S”, becoming “BRICS”.

7) Who runs BRICS?

For most of the time since BRICS was established, gross domestic product China has twice as much as the other four countries combined. In theory, this was supposed to give Beijing greater influence, but in practice, India, which has recently surpassed China in terms of population, represents a counterweight.

BRICS does not officially support China’s major efforts to build infrastructure projects abroad, under the so-called “Belt and Road”. This is due, among other reasons, to India’s objection to the implementation of these projects in the disputed region controlled by Pakistan, its neighbor and archenemy.

There is no controlling shareholder in the New Development Bank, as Beijing has agreed to New Delhi’s proposal that member countries hold equal shares.

Although the bank’s headquarters is in Shanghai, it is managed by an Indian and two Brazilians, the most recent of whom is former Brazilian President Dilma Rousseff.

8) Was BRICS affected by the Russian war?

The other BRICS member states have adopted a largely neutral stance towards the war. It considers it a regional conflict rather than a global crisis.

However, the war changed relations between Russia and the BRICS institutions, as the New Development Bank was quick to freeze Russian projects, and Moscow was unable to obtain dollars through the common foreign exchange system of the BRICS countries.

Fundamentally, in light of the increase in US sanctions, the other countries in the group preferred continued access to the dollar-based financial system over Russia’s assistance.

9) Are investors still interested in BRICS?

There is still keen interest in emerging markets. But BRICS does not receive much attention as an investment destination in the current period, given the geopolitical changes and the different economic paths of the member states.

I was sent away penalties, the United States led most foreign investors from Russia, and sanctions were imposed on a number of sectors in China, especially companies. Technology or face the possibility of being banned from investing in it.

China’s economy is still maturing, is increasingly diverging from other emerging markets, and faces a structural slowdown. Brazil’s economy also slowed significantly after the end of the global commodity boom nearly a decade ago.

South Africa has been plagued by power outages for years, with state utility companies unable to generate enough electricity to meet demand, as well as logistical hurdles.

As for India it is still a growth story that investment banks compare to China 10 or 15 years ago, but it is not yet clear whether it will be able to follow China’s manufacturing-based model.

Will BRICS expansion boost oil investments among its members?

After the joining of Saudi Arabia, the Emirates, and Iran, the group controls 42% of global oil production and 35% of total consumption.

The number of group members doubled. “At the beginning of this year, 5 new countries joined: Egypt, the Emirates, Saudi Arabia, Iran, and Ethiopia, while Argentina refused to join after President Javier Milli took office.

While opinions differ about the extent to which members benefit from expanding the group. The joining of Saudi Arabia, the Emirates, and Iran may help unify the economic goals of the countries that currently control nearly half of the world’s oil supplies on the one hand, and their most important customers in Asia on the other hand. It may also lead to increased investment in refining, chemicals, and marketing among member states, according to “S. &P Global Commodity Insights.

BRICS controls half of oil production

Saudi Arabia, the Emirates, and Iran account for 17% of the world’s oil production. The three countries are the main suppliers of medium-acid crude that is preferred by refineries in Asia, but their market shares face competition from Russian flows, which are sold at a much lower price as a result of the price ceiling mechanism imposed by the group. The seven countries are included sanctions on Russia.

China’s status as the world’s largest oil importer gives it a suitable reason to consolidate its economic relations with Saudi Arabia, the UAE and Iran, as well as Russia and Brazil, according to the agency.

With Saudi Arabia’s accession, BRICS members control 42% of global oil production and 35% of total consumption, according to data from the US Energy Information Administration. The founding countries of the group – such as India and China – also attach importance to the continued smooth flow of energy commodities.

BRICS is getting a boost with Saudi Arabia joining the group of emerging market countries

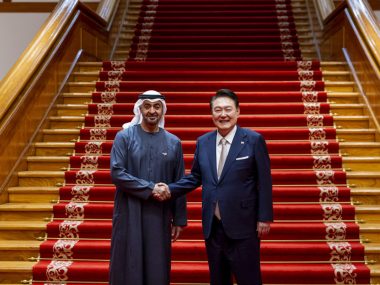

South African Foreign Minister: Saudi Arabia, Iran, Egypt, Ethiopia and the UAE are now full members of the BRICS group

The South African Foreign Minister said: Saudi Arabia and four other countries accepted the invitation to join the Club of Nations.” The expansion of which was approved during last year’s summit.

Minister Naledi Pandor said that Russia, which took over the presidency of the group this year from South Africa, had received written interest from 34 countries wishing to join. She added that Saudi Arabia, the UAE, Egypt, Iran and Ethiopia are now countries that enjoy full membership in BRICS.

Pandor said during a press conference in the capital, Pretoria, on Wednesday, “Argentina sent a letter clarifying that it will not continue to act in accordance with the accepted request made by the previous regime to become a full member state in BRICS, and we accept their decision.”

The leaders of Brazil, Russia, India, China and South Africa agreed to expand the membership of the BRICS group as of January 1, during a summit held in Johannesburg last August.

Pandor pointed out that the BRICS foreign ministers are developing the so-called BRICS partner country model to include 17 countries whose full membership in the group has not been accepted.

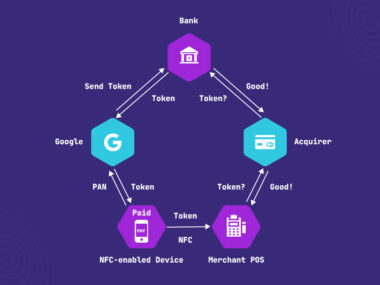

The group is also establishing a framework to allow member states to use their local currencies in intra-BRICS trade. The minister said that the group found that the current international payment system, which relies mostly on the dollar, is “unfair and expensive.”

The most important cooperation in the field of energy

China’s status as the world’s largest oil importer gives it a suitable reason to consolidate its economic relations with Saudi Arabia, the UAE and Iran, as well as Russia and Brazil, according to the agency.

With Saudi Arabia’s accession, BRICS members control 42% of global oil production and 35% of total consumption, according to data from the US Energy Information Administration. The founding countries of the group – such as India and China – also attach importance to the continued smooth flow of energy commodities.

Establishing alternatives to Western economic and political institutions represented an important part of the president’s foreign policy Vladimir Putin. He played a decisive role in establishing several new international organizations, including the Gas Exporting Countries Forum and the Shanghai Cooperation Organization in 2001, the OPEC+ alliance in 2016, and the Eurasian Economic Union.

Russia’s BRICS partners accepted its goal of decoupling from Western economies, and members established the New Development Bank to support infrastructure and sustainable development projects in emerging markets and developing countries.

The OPEC+ oil production alliance agreement is the most important cooperation in the field of energy between Russia and the new BRICS members. This agreement has survived despite the economic slowdown and the invasion of Ukraine, which led to demands to isolate Moscow from the global economy.

However, some analysts believe that the different economies and priorities of the BRICS members will restrict cooperation between them.

It is expected to strengthen Russian efforts to include new members in BRICS during her presidency, and the group’s next leaders’ summit is expected to be held in October in the Russian city of Kazan.

The UAE is poised to expand its currency’s global presence after joining BRICS.

The dirham’s peg to the dollar is supported by huge foreign assets. The UAE enjoys wide geographical diversity in its international trade

The UAE Dirham with the opportunity to become a major addition to the yuan as a new cross-border currency after adding four and perhaps five countries to members” in 2024.

The UAE’s currency appears well-positioned to play an increasingly prominent role in trade and settlement, both inside and outside the expanded BRICS group, according to Sergey Volopov of Bloomberg Intelligence. He said in a report that the dirham enjoys “full convertibility into other foreign currencies, and the long-standing peg of the dirham to the dollar is supported by huge foreign exchange assets. The UAE’s foreign trade is also characterized by geographical diversity, and its banking sector is distinctly developed.”

The UAE is among the highest rated emerging market countries in the world, with credit ratings superior to other BRICS countries. Fitch rates the Gulf country at (AA-), which is the second highest of the agency’s ratings, while Moody’s puts it at its third highest of its ratings at (Aa2).

The UAE’s exit from the “grey list” of the Financial Action Task Force (FATF), concerned with monitoring international crimes, strengthens the role of its currency, according to the report, which indicated that Saudi Arabia’s delay in joining BRICS membership gave the dirham an advantage over the Saudi riyal in consolidating its position as the region’s preferred currency. In cross-border transactions.

Trade settlement experience in dirhams

BRICS member states had some experience settling bilateral trade arrangements in currencies other than the dollar, even before membership was expanded this year.

Reports indicate that UAE banks and the dirham in particular are used to pay for Russian exports, especially oil, to India, in light of the Indian rupee’s lack of global acceptance. Bloomberg Economics estimates that the size of the settlements amounts to several billion dollars.

India’s dues to Russia amount to several billion dollars on a quarterly basis, and have now largely been settled. But in the wake of recent restrictions on India’s energy imports from Russia, the huge backlog is unlikely to be repeated, according to Bloomberg Intelligence.

BRICS currencies achieve gains outside the group

In addition to the increasing use of BRICS currencies in bilateral trade between member states and financial flows within the group, some non-member countries in the Europe, Middle East and Africa region have also recorded a greater volume of transactions relying on these currencies.

The combined share of the dirham, yuan and ruble in Turkey’s total trade settlements rose to 1.9% at the end of 2023, after being at almost zero four years ago. The greatest reliance on the dirham over the past year came despite the fact that Turkey’s 5% imports from the UAE were less than half of China’s imports, and also less than a third of imports from Russia, according to Bloomberg Intelligence.

Other changes in the foreign exchange structure of Turkish trade have been less drastic, with total dollar and euro trading combined declining by 2 percentage points since 2020 to 91% of total trade, with the US currency’s share falling to 61% from 63%, and the euro still accounting for about 30%.

BRICS controls half of oil production

The UAE and Saudi Arabia’s accession to BRICS is of particular importance, as it will bring to the group two of the world’s largest commodity exporters, extensive trade relations with existing Asian members China and India, and large pools of reserve assets and well-capitalized banking sectors.

Upon Saudi Arabia’s expected accession, BRICS members will control 42% of global oil production and 35% of total consumption, according to data from the US Energy Information Administration. The founding countries of the group – such as India and China – also attach importance to the continued smooth flow of energy commodities.

Indonesia, for example, has not yet joined the BRICS+ group, but its economy is larger than Egypt, Saudi Arabia, and the United Arab Emirates, and it is likely to outgrow two of the three countries. Nigeria and Thailand both outperformed Iran on O’Neill’s two criteria. Mexico and Turkey are ahead of Argentina. The same applies to Bangladesh when compared with Ethiopia.

The implication is clear. BRICS expansion is less about economics and more about politics. The drivers of expansion are challenging US hegemony, eliminating the dollar as the world’s main currency, and creating alternative institutions to the International Monetary Fund and the World Bank, both of which are headquartered in Washington.

Economic weight = political influence

Can the BRICS group achieve this goal? The group has several advantages: size, diversity and ambition.

First, the enlarged BRICS is actually larger than the Group of Seven major industrialized nations, which includes Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States of America. During 2022, the bloc represented 36% of the global economy, compared to 30% for the group of economically developed countries. Our projections indicate that the expanding workforce and huge scope for technological catch-up will expand the BRICS+ share to 45% by 2040, compared to 21% for the G7 economies. In practice, BRICS+ and the G7 will exchange positions in relative size until 2040. Enjoying economic weight will also mean enjoying political influence.

Second, the bloc’s membership will include some of the world’s largest oil exporters (Saudi Arabia, Russia, the United Arab Emirates, and Iran) and some of its largest importers (China and India). If the adoption of currencies other than the dollar to settle some oil deals succeeds, this may indirectly affect the US currency’s share of international trade and global foreign exchange reserves.

Third, it has become clear that weakening the dollar’s dominance is one of the ambitions of BRICS+. China has sought greatly to strengthen the role of the yuan in global trade. Brazilian President Luiz Inacio Lula da Silva called on the bloc to finding an alternative to the US dollarWhile Russia sees economic restructuring toward China and away from Europe as the only rational option as it continues its war on Ukraine, and because of sanctions, Moscow is effectively selling oil to China in yuan.

Asymmetrical pieces

However, looking deeper than the surface, BRICS+ also faces some challenges ahead.

BRICS+ is indeed big and growing, but China’s debt problems and a property market correction mean that one of the group’s main drivers is fading. The bloc’s prominence this century has been largely due to Beijing’s astonishing economic growth, averaging 9% a year between 2000 and 2019. That pace is likely to fall to 4.5% in the 2020s, 3% in the 2030s and 2% in the 2040s. India may also stagnate somewhat, but its economic ascent and political ambition are unlikely to match China’s.

BRICS includes oil exporting and oil importing countries as members, but some of them conduct oil deals in US dollars. Producing countries Saudi Arabia and the United Arab Emirates peg their currencies to the dollar and need US currency reserves to support their financial positions. Even without a peg, the majority of countries – unless they are subject to sanctions such as Iran or Russia – prefer payments in dollars as the most acceptable trading medium in international trade.

There is reluctance in the BRICS group to promote an alternative currency. Russia does not want to obtain the rupee from India in exchange for its oil, because it does not want to accumulate its savings in India. But what if India makes payments to Russia in Chinese yuan? Here the geopolitical competition between New Delhi and Beijing emerges. As the former will not want to promote the use of the Chinese yuan in global trade.

Finally, the enlarged bloc lacks consensus and cohesion; India suffers from Border Dispute Renewed with China. Tensions may worsen as India rises and China declines.

Saudi Arabia and Iran recently resumed diplomatic relations; But a deep division resulting from proxy wars may require difficulty to bridge. New Delhi and Riyadh also signed – along with the UAE – a memorandum of understanding with the United States of America and Europe to create an economic corridor that competes with China’s “Belt and Road” initiative.

Adjusting the center of gravity

What about alternatives to the IMF and World Bank? Again, this will likely remain more aspiration than reality. The New Development Bank, the BRICS equivalent of the World Bank, has spent little money. The BRICS Contingent Reserve Arrangement, which is supposed to be a rival to the IMF, is small and of limited use.

The idea of a single BRICS currency, with a unified monetary policy, seems unlikely, especially at the present time. Brazil cuts interest rates while Russia raises them sharply; While the UAE and Saudi Arabia mimic everything that the US Federal Reserve does. When we see the Eurozone facing difficulties in light of a unified currency and monetary policy, the BRICS group of countries may not be able to find a unified currency according to the “one size for all” rule from the beginning.

This does not mean that the surprising rise of the BRICS group will be without repercussions on the global economy. The center of gravity will shift to the east and south, where governments enjoy lower levels of popular representation and intervene more in markets than in the West.

Within the BRICS+ group of countries, only Argentina, Brazil and South Africa were rated “free” by Freedom House last year. India was described as “partly free,” while China, Egypt, Ethiopia, Iran, Russia, Saudi Arabia, and the UAE were described as “not free.” When we measure the contribution to global GDP from countries classified as “partly free” or “not free,” we find that it has increased from 24% in 1990 to 49% in 2022. Our expectations indicate that this percentage will increase to 62% by 2040.

Things look even bleaker for advocates of liberal markets. The Heritage Foundation, a conservative US think tank, rates almost all BRICS+ economies as “mostly unfree” or worse. While the G7 economies were classified as “mostly free” or “relatively free.”

But the contribution to global GDP by economies classified by the Heritage Foundation as “mostly unfree” or “repressed” actually jumped from 27% in 1995 to 44% in 2022, and by 2040 our expectations indicate that it will rise to 56%. %.

The BRICS group of countries will change the world, but this may be due more to their growing share of GDP and diverging political and economic systems than to fulfill the grand plans of their policymakers.

Russian official: Reaching a unified currency among the BRICS countries is possible in the future

He was considered an official in the Ministry of Foreign Affairs Russia that access to a unified currency among members of a group” “It is possible in the future.”

The head of the Economic Cooperation Department at the Russian Foreign Ministry, Dmitry Berichevsky, said in an interview with BRICS TV, reported by the Russian TASS agency, that a common currency is “quite possible in the future,” but he warned that the path will not be “quick or easy.”

When the BRICS summit in South Africa was held it included China, Russia, Brazil and India. The leaders of countries extended an invitation to everyone Saudi Arabia, and the UAE And Egypt, Ethiopia, Argentina and Iran to join the group.

The summit also mandated the financial agencies of member states to formulate initiatives related to the broader use of national currencies and common payment instruments, by the next summit in 2024.

Several difficulties

Since its establishment; The bloc has failed to transform its growing economic power into huge political influence since it began holding leaders’ summits 15 years ago.

But the current state of fragmentation in the global system, with the worsening disputes between the United States and China, and divisions over the Russian invasion of Ukraine, gives it a new opportunity to become a louder voice for the Global South, and perhaps compete with the United States and its allies.

For its part, S&P Global Ratings considered in a recent report that achieving the BRICS group’s long-term goal of establishing a common currency will be difficult due to the different levels of economic development among member states, and also because the existence of a region dealing with a single currency requires members to coordinate monetary policies and allow the free flow of capital, which may not be politically acceptable for some countries.

As for the group’s goal for the near term: It is to increase direct transactions in local currencies and abandon the dollar to reduce dependence on the American financial system. It is not expected that there will be a major shift away from the dollar, while according to the report it is likely that the Chinese yuan will be the main beneficiary of the increase in exchanges in local currencies, given that China has. The largest volume of foreign trade among the countries of the block.