|

Neubauer Coporation

Getting your Trinity Audio player ready...

|

The recent flare-up follows rising Iran-Israel hostility over the last two years as Iran has ramped up its nuclear program, which Israel staunchly opposes

Recent missile strikes by Iran against Israel mark a clear escalation in tensions between the two nations, heightening geopolitical uncertainty across the Middle East and North Africa. However, the economic impact has remained limited to date, according to analysts.

“This is Iran’s first-ever direct attack on Israel. It marks an increase in geopolitical tensions and a clear shift from our previous baseline scenario. We do expect Israel to respond to the recent strikes by Iran, but it is unclear at this stage what form that response will take or when,” Moody’s said in a statement on Tuesday.

Nevertheless, damage to Israel has been minimal as nearly all incoming missiles and drones were intercepted successfully. Major infrastructure like offshore natural gas fields and utilities were unaffected. Financial markets also took the exchanges in stride, with benchmark Brent crude oil prices holding around $90 per barrel.

According to credit rating agency Moody’s, risks for now are captured in the current negative outlook on Israel’s A2 sovereign rating. Israeli banks and insurers have likewise proved resilient thus far. Direct asset holdings in the region by foreigners are limited as well.

However, the situation remains precarious. Analysts say further tit-for-tat strikes could occur, raising the chances of miscalculation. This highlights the potential for an escalation into a full-blown and economically damaging conflict.

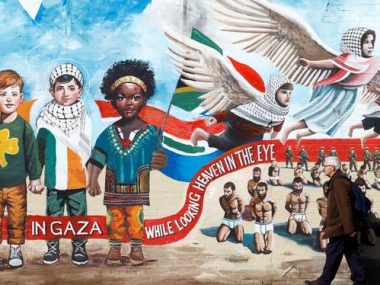

Gaza plunges into recession, World Bank warns of economic spillover risks

A World Bank report paints a bleak picture of economic devastation in Gaza. Economic activity in Gaza has come to a near standstill with GDP dropping 86 percent in last quarter of 2023.

“The West Bank has plunged into a recession, with simultaneous public and private sector crises,” the World Bank said in a statement on Tuesday.

Elsewhere in the region, the World Bank says economic spillovers have remained relatively contained but uncertainty has increased. For example, the shipping industry has coped with shocks to maritime transport by rerouting vessels away from the Red Sea, but prolonged disruptions could raise commodity prices regionally and globally.

The World Bank report highlights rising debt burdens in MENA economies, even predating the pandemic. Between 2013 and 2019, the median debt-to-GDP ratio increased over 23 percentage points. The pandemic exacerbated this trend. Oil importers now have a debt-to-GDP ratio 50 percent higher than the EMDE average, approaching 90 percent in 2023.

Economic impact of a full-blown Israel-Iran conflict

According to Moody’s, a full-blown Israel-Iran conflict would have severe economic consequences, potentially attacking energy infrastructure, closing transport routes, and sustaining airspace closures. This could draw in the US and others, damaging investor sentiment and tightening financial conditions.

“A full-blown conflict between Israel and Iran could draw in the US and other countries. It could also include potential attacks on critical energy infrastructure, the attempted closure of transport routes such as the Strait of Hormuz, or result in the sustained closure of airspace in the Middle East. This could damage investor sentiment and

increase volatility in financial markets, resulting in tighter financial conditions across the region,” Moody’s said.

The three main transmission channels for wider negative effects across the MENA region would be: heightened security concerns, energy and supply chain disruptions, and weaker overall macroeconomic and financial conditions.

Prolonged fighting could disrupt critical oil exports from the Middle East, leading prices to spike globally. However, most analysts think it would require a severe and sustained increase to push the world into recession.

The fallout on regional economies would vary. Those with strong trade and financial ties like Egypt and Jordan may suffer the most. Tourism-reliant nations could also take a heavy hit from skittish travelers. And fragile countries like Yemen may see foreign aid diverted.

Still, should the US get directly involved, the risks to the global economy would intensify. Analysts believe US military support for Israel would be primarily defensive to avoid a regional conflict. However, unintended consequences are possible.

For now, most experts put low probability on a full-scale war between Israel and Iran given the massive costs. Instead, they expect periodic but limited exchanges.

The recent flare-up follows rising Iran-Israel hostility over the last two years as Iran has ramped up its nuclear program, which Israel staunchly opposes.

While direct economic impacts may remain contained short-term, the chances of miscalculation have grown. The severe disruption potential from outright conflict, even if low probability, means investors should monitor events closely.

MENA economic outlook

The World Bank report says economic growth in the MENA region is expected to remain low in 2024. The region’s GDP is forecast to increase 2.7 percent in 2024, only a small improvement from 1.9 percent growth last year.

Similar to 2023, oil importing and exporting countries in MENA will likely grow at comparable rates in 2024. This contrasts with 2022 when higher oil prices boosted growth more in oil exporters.

For Gulf countries, the 2024 growth increase reflects hopes of strong non-oil economic activity and a phasing out of oil production cuts by year-end. However, growth in most oil-importing nations in the region is expected to slow down.